The effects of obtaining a DUI are much a lot more extreme than numerous other driving incidents. Figuring out the lawful repercussions can be complicated by itself, and afterwards there is the issue of your auto insurance policy. Your insurance rates will typically see a steep rise once a DUI is on your record.

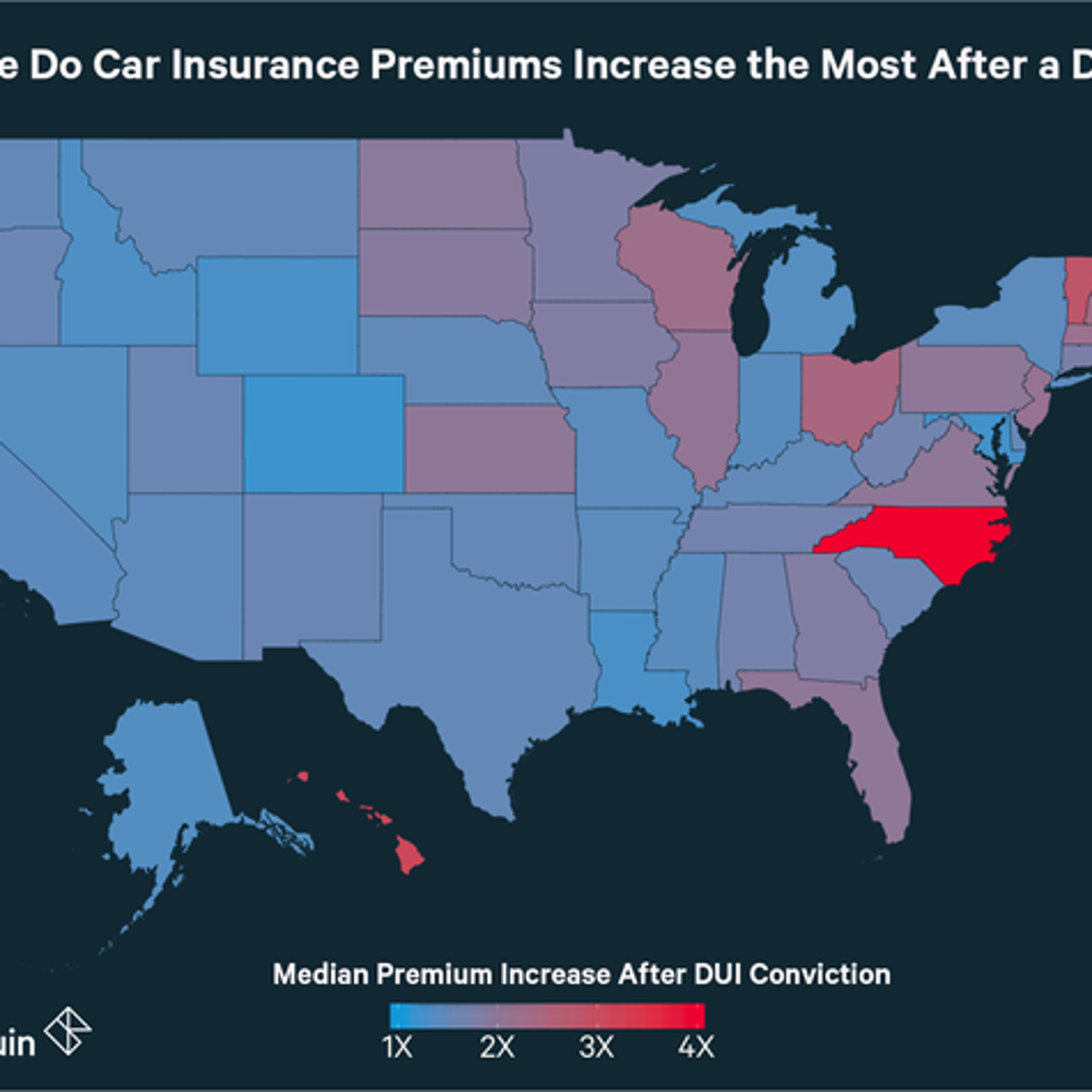

On the whole, insurance policy providers in this state levy one of the most serious rise in automobile insurance coverage prices for motorists with DUIs in the entire nation. California, California tape-recorded 3,259 deadly cars and truck accidents in 2018 also, with 1,369 fatalities tied to dwi. Though these numbers are greater in overall than North Carolina, prices in California are 2nd highest in overall increase when a DUI is factored in.

However the ordinary insurance coverage price boost for those who get a DUI are still amongst the highest in the country, with a typical annual complete coverage rate boost of $1,566. Louisiana Although its population is a lot bigger than that of Hawaii, the price of casualties in Louisiana are still much reduced than the various other states noted above.

The Single Strategy To Use For How Long Does Dui Affect Insurance In California ...

Below are other factors to how much is car insurance consider when purchasing for affordable auto insurance coverage with a DUI: General rates for nationwide providers, High-risk insurance companies, Safe driving price cuts, Vehicle driver security training discounts, If you do not certify for insurance coverage from the companies over, it assists to recognize some suppliers specialize in offering rates for high-risk chauffeurs.

As an example, in Alaska it can remain on your document permanently. The length of time after a DUI does your insurance policy drop? The ordinary length of time that a DRUNK DRIVING will influence your insurance policy differs by state, carrier as well as whether or not suppliers maintain rates greater as long as the DUI remains on your record.

The takeaway, Getting a DUI will typically cause higher insurance policy rates. The increase in your rates will certainly depend upon your insurance policy provider and also the state you stay in, among various other aspects. A DRUNK DRIVING will normally remain on your driving record for years. You will probably have to pay higher prices for as lengthy as your DUI is on your driving document.

The Basic Principles Of How Much Does Your Insurance Go Up For Reckless Driving ...

You might need to discover a different insurance policy business if your current one attempts to gouge you unfairly. Consult your insurance coverage representative to locate out even more concerning obtaining coverage if you obtain a DUI or DWI as well as locate on your own a lawyer.

08 BACThese are sample rates and ought to be made use of for relative objectives just. Your quotes might be different. Rates are identified based upon 2020 Quadrant Details Services data.

Getting a DUI will raise your vehicle insurance policy prices in nearly every scenario, commonly considerably. You can end up paying two times as much for insurance coverage, typically a lot more usually, we discovered a solitary DRUNK DRIVING raised cars and truck insurance policy rates by 72%. A drunken driving citation can impact your premiums for a number of years, approximately five in some states.

Excitement About New York Car Insurance Premiums After A Dui/dwi (Quotes ...

Vehicle insurance companies typically see more youthful motorists as riskier to guarantee, so age plays a large function in just how much your premium boosts complying with a conviction. Insurance for an 18-year-old who has been founded guilty of driving drunk within the previous year would certainly set you back approximately greater than two as well as a half times as a lot as the price for a 30-year-old with the very same history in Georgia, New York City as well as Illinois.

A 30-year-old with 4 DUIs can expect complete coverage costs to be 285% more pricey than premiums for a person with one DUI based upon our three-state example. Every insurance coverage service provider has a various formula for setting rates, so we suggest contrasting at the very least three quotes to help guarantee you obtain the cheapest automobile insurance coverage prices after a DUI.

In our study, State Farm really did not enhance vehicle insurance rates as much as Allstate and Geico did following a DUI sentence. How do insurance policy firms find out about a DRUNK DRIVING?

Not known Details About Car Insurance, Duis And Sr22s - How Your Rates Can Skyrocket

, and your insurer may drop your plan completely. The very best thing you can do is be straightforward with your insurance provider since you may require to ask it to file an in your place. These types verify you have the state's minimum responsibility auto insurance, which is called for if you wish to maintain or reinstate your driving benefits.