Auto insurance does go down at 25. The ordinary cost of car insurance coverage for a 25-year-old is $3,207 for an annual plan.

Our analysis discovered that prices decrease a lot extra at other 1 year intervals. Read on for more information details regarding when cars and truck insurance does decrease. When does vehicle insurance get more affordable for young vehicle drivers? Provided they keep a clean record, young chauffeurs will likely see their cars and truck insurance drop after each year driving when driving yet how much it really decreases by differs from year to year.

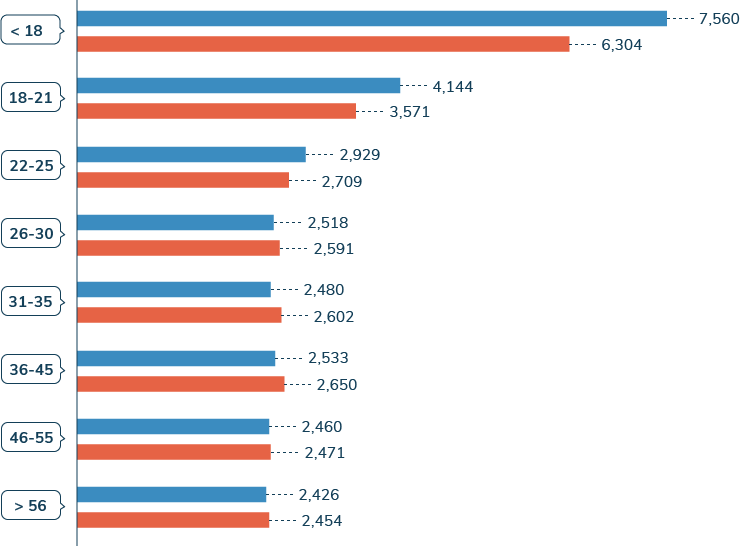

What age does car insurance go down for males vs. women? Your car insurance coverage does drop after you turn 25, however not as high as it does on other birthday celebrations. Nonetheless, unless you stay in a state where insurers can't factor gender right into insurance coverage prices, one substantial adjustment occur at age 25: the difference between what man and women motorists spend for vehicle insurance coverage.

The Single Strategy To Use For Cheapest Car Insurance Companies (July 2021) - U.s. News ...

Does auto insurance policy from major nationwide insurance providers go down at 25? We assessed quotes from four of the largest car insurance firms Geico, State Ranch, USAA and also Progressive and also discovered that while car insurance coverage does drop at 25 with each of them, the amount it decreases by differs substantially.

Exactly how to obtain your auto insurance coverage down as a 25-year-old motorist If you're a young vehicle driver in your 20s, you have actually likely asked yourself just how to lower your automobile insurance policy expenses. Fortunately is, motorists of this age can make the most of a number of methods and also discount rates to make their auto insurance coverage prices drop.

There are various other ways for 25-year-olds to obtain their insurance coverage rates to go down. Bought a shiny new sports car?

The Main Principles Of Does Car Insurance Go Down At Age 25? - Progressive

If your vehicle is just worth a few thousand dollars, it does not make feeling to spend for high premiums to cover an asset of restricted value. If you're married and each of you drives separate automobiles, you might have the ability to minimize your auto insurance payment by, as insurance providers take into consideration wedded couples much more financially secure as well as risk-averse.

Discount rates for 25-year-old motorists As you go shopping around for the finest price, make certain you're additionally asking insurer regarding all applicable discounts. Twenty-five-year-old vehicle drivers might not be able to take benefit of student-away-from-home or good-student policies, however there are lots of various other methods these young drivers can reduce auto insurance: You may not have the ability to get a good-student discount rate any longer, but your university might have partnered with an insurance provider to secure price cuts for alumni.

While the majority of insurers apply this price cut instantly, be sure to ask so you understand you are getting the optimum advantage. Know that you're a secure vehicle driver, yet still paying high prices?

What Does Why Is My Car Insurance Going Up? And What Can I Do ... Do?

By taking a, you'll not only find out exactly how to drive more securely, yet you can decrease your auto insurance coverage costs anywhere from 5% to 20%. Be recommended, nonetheless, that some states and some insurance companies only prolong this discount rate to seniors or vehicle drivers under 25. Talk to your insurance provider to see if you certify prior to you sign up for a course.

Does your auto have particular security functions, such as anti-lock brakes or daytime running lights? Ask concerning these discounts when you call insurance coverage companies for a quote.

Risk assessors have determined that those 25 or older are more likely to be more liable which their danger of at-fault crashes has actually lowered. So the base price for your cars and truck insurance coverage plan changes at this age due to the fact that you've grown right into a far better vehicle driver course; it's not a auto insurance price cut for transforming 25 as some think.

The Definitive Guide for Answers To The Top 5 Questions About Auto Insurance - Your ...

Insurer score systems and aspects can vary, in addition to the state regulations regulating them, so just how much your auto insurance coverage rates will transform will vary. We have actually seen rates reduced as long as 20 percent as soon as a driver gets to the age of 25, if that person has actually kept a clean driving document and had no crashes.